The balance sheet recession is still lean and mean. Macro picture remains weak. It will be essential to monitor the next ISM print on the 1st of July. If it points below 50, the US will be again in recession territory.

Great question by Steve Keen and great analysis:

Dude! Where’s My Recovery? - by Steve Keen on June 11th

The fears expressed in my blog of the risks of a double dip in the US are coming closer to realisation unfortunately.

New Home Sales in May at 319K, down from 326K in April. New Home Sales are still in the dumpster:

Great question by Steve Keen and great analysis:

Dude! Where’s My Recovery? - by Steve Keen on June 11th

The fears expressed in my blog of the risks of a double dip in the US are coming closer to realisation unfortunately.

New Home Sales in May at 319K, down from 326K in April. New Home Sales are still in the dumpster:

Take a closer look on a 5 year scale, it ain't pretty:

New One Family Houses Sold: United States

Average Sales Price for New Houses Sold in the United States - Volatile:

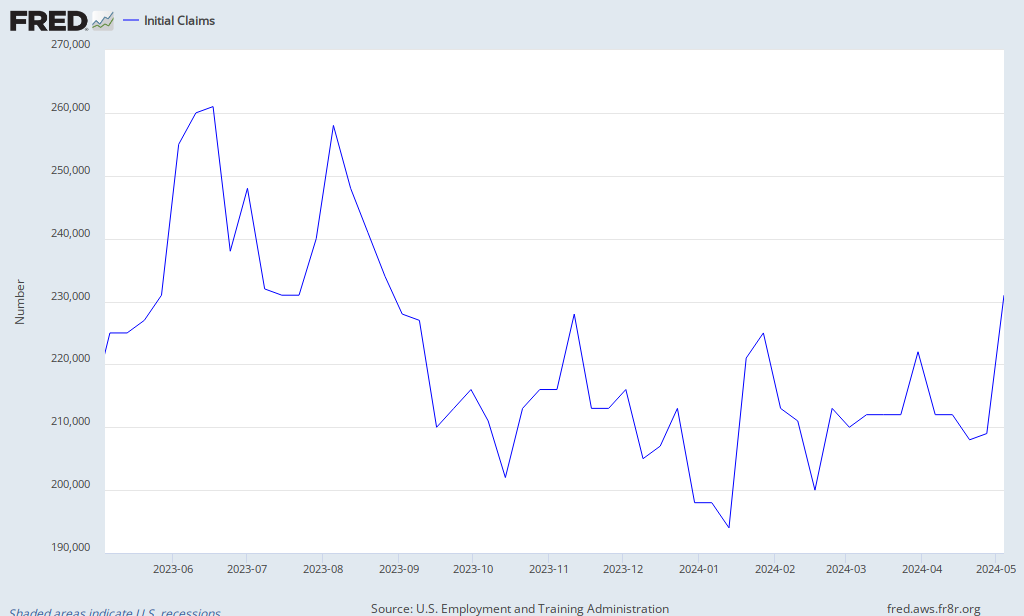

Initial claims going up again in the US, it isn't going to help President Obama's re-election:

Initial Claims for Unemployment Insurance rose by 9000 last week to 429000. Worse than the expected level of 413000.

In the rates and credit spaces, we had another volatile session.

Huge movement on the 10 Year German Bund government bond today, signifying a huge flight to quality move:

The 10-year German bund yield fell eight basis points to 2.86%, getting very close to a 5 months low. September bund future made a new contract high of 127.04.

Meanwhile Portuguese 2 Year notes reached a new record to 14.39%, 70 basis points wider.

Irish yields widened by 46 bps to 13.70%.

Spanish 2 Year notes widened by 16bps to 3.59%.

iTraxx SovX 5 year index reached 233 bps (record was reached on the 16th at 236bps). Greece represents 1/15th of the index as a reminder.

For Standard & Poor’s and Moody’s, a rollover of Greek debt would mean default.

And to add to the nasty sell-off Moody's warned it could downgrade 16 Italian banks including Intesa Sanpaolo, Banca Monte dei Paschi di Siena, Banca Nazionale del Lavoro and Cassa Depositi e Prestiti.

Italian Banks CDS trading wider today:

![[Graph Name]](http://i8.createsend2.com/ei/y/7B/CBD/5D4/215929/images/itbanks.gif)

A classic scenario we've seen before, first the shots are fired accross the Sovereign country, then the banks get impacted next. Why? Banks are like second derivatives of an economy, if a country gets downgraded, so will its banks, pushing them even more into difficulties.

Whatever happens to Greece, as I posted in "European issues and the Greek jinx - Macro update, a focus on Iceland and more", its banks are in big trouble:

The ECB has threatened not to accept Greek government bonds as collateral if Greek debt was restructured. If the ECB follow through its threat, a liquidity crisis in Greece, bank runs and other social unrest on a big scale will occur, make no mistake. The AESE Greek equity index would get smoked in similar fashion as the ICEXI icelandic index got whacked given its composition and bank weighting.

A reminder from my previous post - ICEXI got obliterated:

EUR/CHF still displaying the ongoing flight to quality mode, breaking another record today: EUR/CHF hit 1.1902 during European afternoon trade, the pair's all-time low...

Also today, Oil fell 4.6% as the International Energy Agency announced the release of 2 million barrels a day for 30 days beginning next week. Looks like they want to release the pressure on US households finances with this move. A very little too late?